ad valorem tax florida exemption

Ad valorem means based on value. This application is for.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.

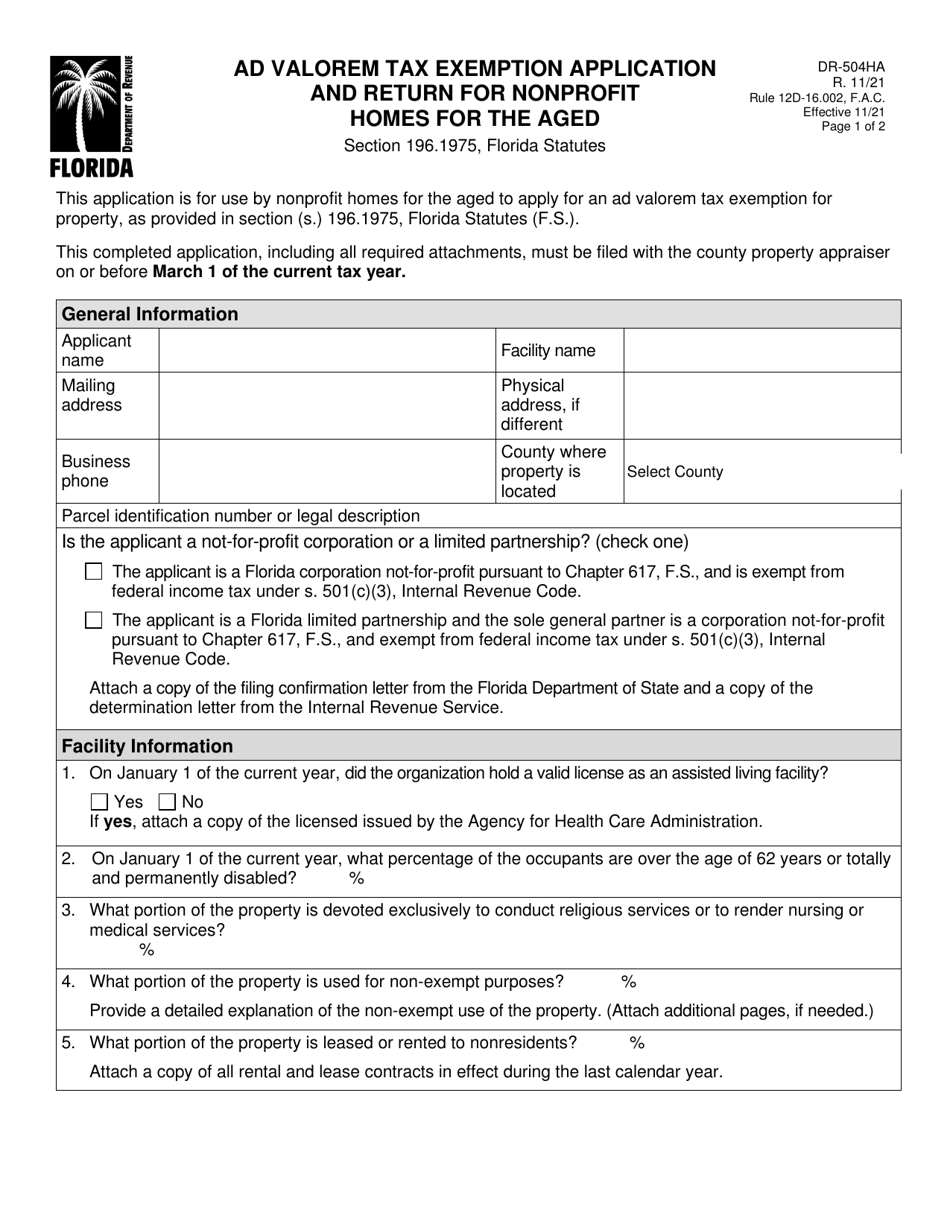

. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

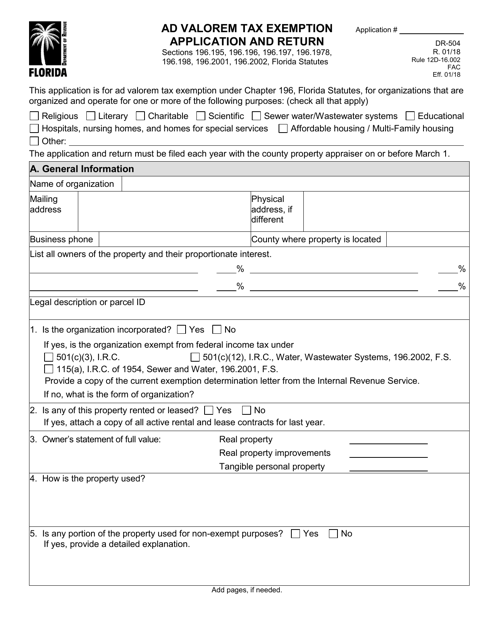

The greater the value the higher the assessment. Sections 196195 196196 and 196197 Florida Statutes. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION HOMES FOR THE AGED Section 1961975 Florida Statutes PART A.

Attachment to Form DR-504 - Ad Valorem Tax Exemption Application Question 9 The property is exempt under the provisions Section 1961978 Florida Statutes the affordable housing. Exempt purposes before granting an ad valorem tax exemption. The Florida Supreme Court has held that land owned and used by the state or by a county is immune from ad valorem taxation.

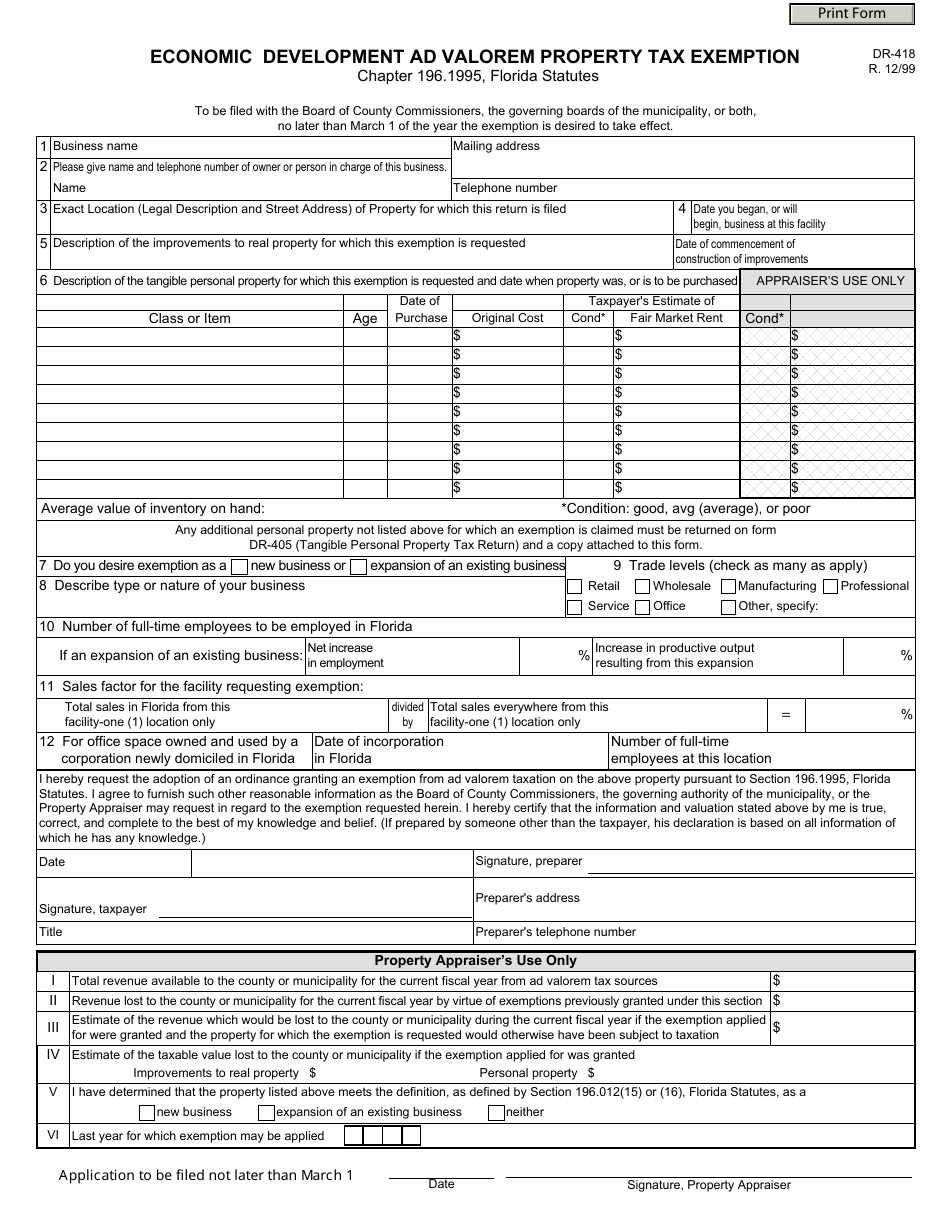

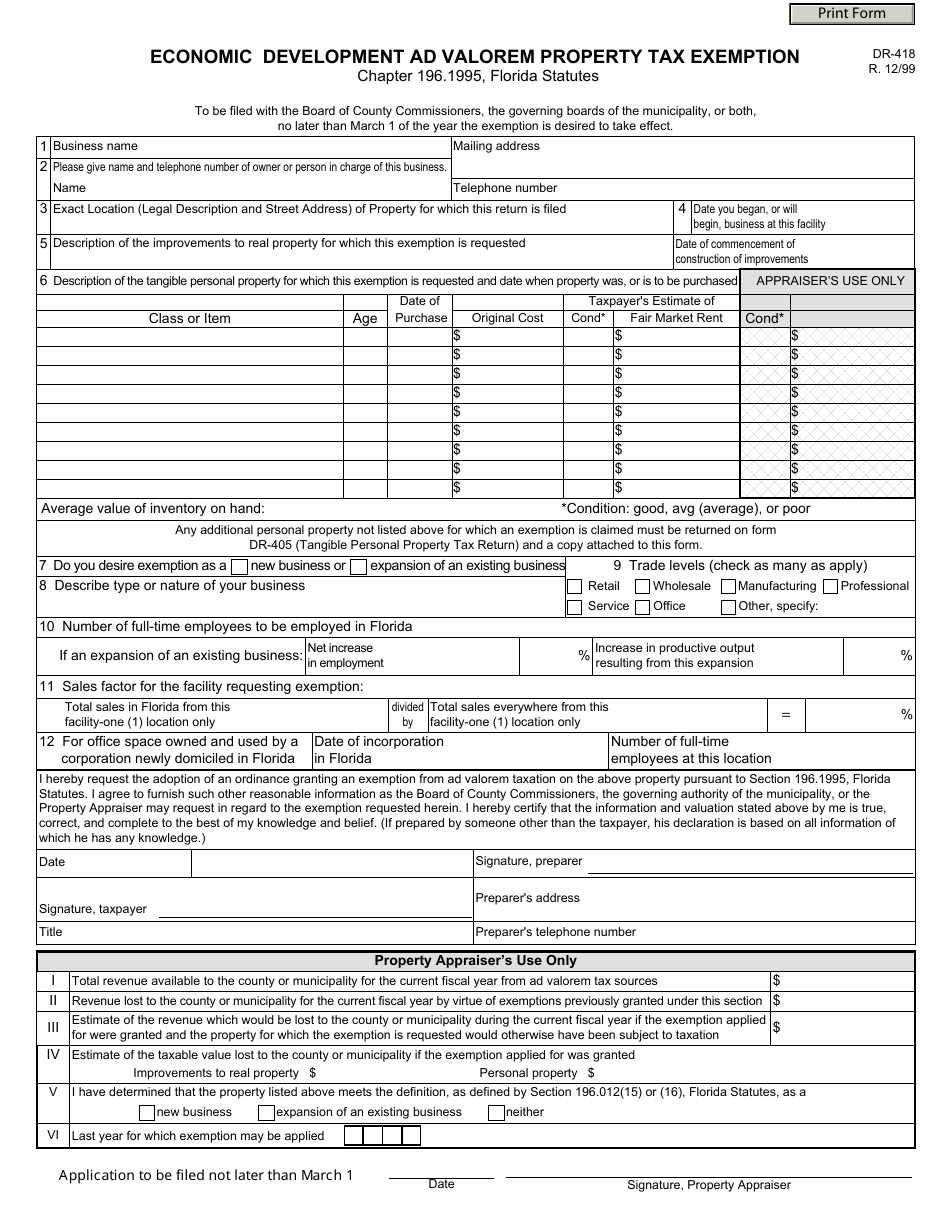

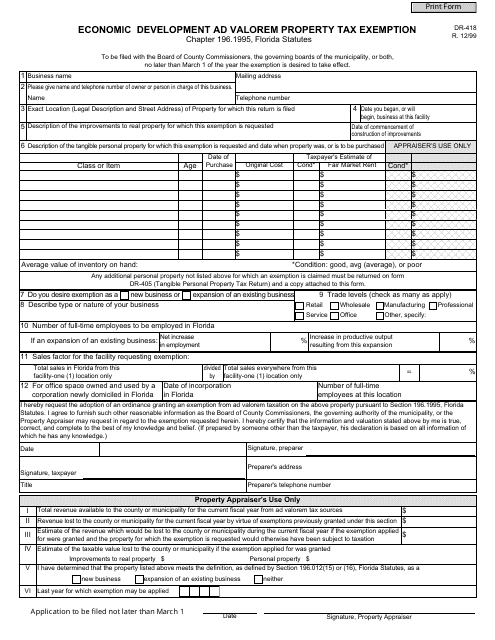

This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances. Florida Administrative Code. The tax exemption runs for a period of 10 years.

Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property. Section 1961978 Florida Statutes. Property Tax Exemption for Historic Properties.

Property appraisers will notify you if additional information or documentation is needed to determine eligibility for the. Completed by each resident. City of Tallahassee 325 So2d 1 Fla.

Recently Alachua County denied a longstanding exemption from the Gainesville Area Chamber of Commerce which had been previously operating under an ad valorem. On Thursday May 4 2017 the legislature enrolled a bill for the governors signature regarding renewable energy devices such as solar panels exempting 80 of their. A veteran who was honorably discharged from the armed forces and who.

Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. When the 10 years have lapsed the tax exemption is removed from that folio number and the building is assessed as normal.

The most common ad valorem taxes are property taxes levied on. Name Spouses name Tax. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

1101 AD VALOREM TAX EXEMPTION APPLICATION AND RETURN HOMES FOR THE AGED Section 1961975 Florida Statutes This form must be signed and returned on or. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older.

196199 Government property exemption. This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for an exempt purpose as provided in sections ss 196195 196196 and 196197 Florida Statutes. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are. PdfFiller allows users to edit sign fill and share all type of documents online. The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average salaries to.

AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR MULTIFAMILY PROJECT AND. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION.

All property of the United States is exempt from ad valorem taxation except such property as is subject to tax by. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure. The 2021 Florida Statutes.

Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant. HOMES FOR THE AGED. Florida law provides additional property tax relief for residents who have served in the United States military.

Florida law provides for a number of ad valorem property tax exemptions which will reduce the taxable value of a property. Collier County Tax Collector 3291 Tamiami Trail. Did you possess a valid license under Chapters 395 400 or part I of.

Real Estate Property Tax Constitutional Tax Collector

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

Understanding Your Tax Bill Seminole County Tax Collector

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

Exemptions Hardee County Property Appraiser

Real Estate Taxes City Of Palm Coast Florida

Form Dr 504ha Fillable Ad Valorem Tax Exemption Application And Return Homes For The Aged N 11 01

Form Dr 504 Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return Florida Templateroller

Homestead Exemption Attorney Fort Lauderdale Martindale Com

What Is A Homestead Exemption And How Does It Work Lendingtree

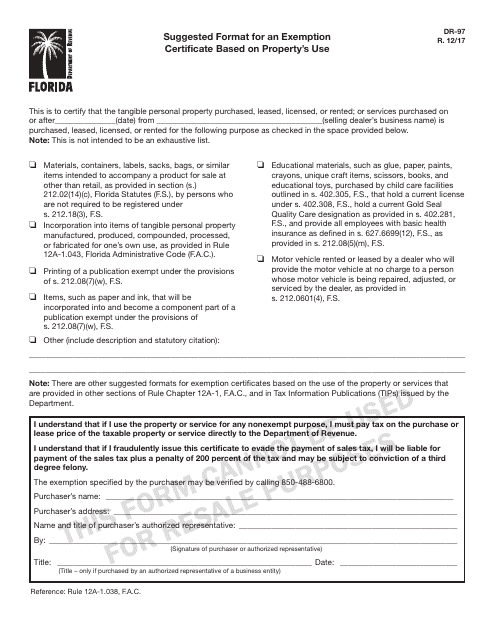

Form Dr 97 Download Printable Pdf Or Fill Online Suggested Format For An Exemption Certificate Based On Property S Use Florida Templateroller

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

A Guide To Your Property Tax Bill Alachua County Tax Collector

Form Dr 418e Fillable Enterprise Zone Ad Valorem Property Tax Exemption Child Care Facility Application For Exemption Certification N 12 99

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller